The Ultimate Audit Playbook

Your Quick-Win Guide to Getting Maximum Value from Validis

- 1.1 – 12+ standardized work papers

- 1.2 – Get ALL the data in minutes

- 1.3 – Minutes to standardize

- 1.4 – One format, all clients

- 3.1 – Analyze multi-year trends

- 3.2 – Access complete populations

- 3.3 – Filter for high-risk items

- 3.4 – Drill into sub-ledgers

👋 Welcome

We’ve done a deep dive into our most successful audit customers and distilled those insights into five practical tips:

- Instant Standardized Work Papers

- Leverage Validis Analytics Dashboard

- Interrogate 100% of Source Data

- Integrate Your Audit Tools

- Turn Clients into Super Fans

This playbook goes beyond time-savings to help you spot risks quickly, ask smarter questions, and turn your clients into genuine advocates for your modern approach. Think of this as your busy season cheat sheet.

There are two ways to use this playbook:

- Read it from start to finish

- Use the navigation on the left ⬅️ to jump to the tip that’s most relevant to you right now

💬 Don’t get stuck trying to figure things out alone. Your account manager and our support team (that blue button in the top left of your dashboard) are here to help you succeed.

Best,

The Validis Team

Who’s This For?

The Time-Starved Auditor → You’re spending hours cleaning data when you’d rather be analyzing it and adding real value to your clients.

The Returning User → You used Validis last busy season but want to unlock more advanced features and ensure you’re getting maximum value.

The Detail-Oriented Professional → You want to understand exactly how to leverage every feature to deliver better audits faster.

The Quality-Focused Auditor → You’re looking for ways to ask smarter questions, identify risks earlier, and impress clients with deeper insights.

The Efficiency Expert → You want to eliminate those awkward client conversations where you’re asking for data without really knowing what you need until you see it.

Whether you’re brand new to Validis or you’ve been using it for years, this playbook will help you work smarter, not harder.

The Data Bottleneck Problem

Most audits get stuck in the same frustrating cycle:

chase data → wait for responses → clean formats → discover you need more → repeat.

These bottlenecks don’t just waste time – they force you into reactive mode when you should be driving strategic insights.

The traditional audit workflow creates three critical chokepoints:

- Collecting Data takes days when it should take minutes

- Format inconsistencies force manual cleanup across different ERPs

- Workflow fragmentation means re-entering the same data multiple times

Validis eliminates these bottlenecks entirely with a streamlined process:

Planning, Execution and Reporting

| AUDIT PHASE | HOW VALIDIS ELIMINATES BOTTLENECKS | KEY BENEFITS |

|---|---|---|

| Planning |

|

|

| Execution |

|

|

| Reporting |

|

|

- Planning: Start Smart, Not Scrambling

Get the data first so you can walk into planning meetings armed with actual insights instead of generic questions. When you can say “Why did your working capital improve by 15% but days receivables outstanding increased” instead of “Tell me what changed this year,” you demonstrate expertise that clients notice and helps auditor focus on cash flow.

→ See Tip #2: Leverage Validis Analytics Dashboard for detailed guidance

- Execution: Investigation, Not Administration

Go where the data tells you. And use your deep data insights to identify areas where you can help clients beyond compliance. When you understand their financial performance this well, advisory conversations happen naturally.

→ See Tip #3: Interrogate 100% of Source Data for advanced techniques

- Reporting: Professional Consistency

Access to complete population data allows you to choose risk-based samples that provide valuable insights rather than hoping random selections catch something important.

Generate white-labeled deliverables that always balance on the first try. Every engagement looks polished and professional, regardless of the client’s underlying ERP system. Your clients will love how easy it is to work with you.

→ See Tip #1: Instant Standardized Work Papers and Tip #5: Turn Clients into Super Fans

🎯 Take Action:

- Review your current audit timeline and identify where data delays typically occur. These are your biggest opportunities for time savings with Validis.

- Review the list of accounting packages we connect to and how clients can upload data.

Why Validis: Beyond Just Saving Time

Let’s be honest – saving 8+ hours per audit is reason enough to use Validis. But when you see how dramatically it changes your entire approach to auditing, time savings become just one piece of a much bigger transformation.

· You Can’t Automate Your Value

While Validis handles data collection and standardization, your analytical skills and insights remain irreplaceable. The difference is that you’re now applying those skills to strategic analysis instead of data formatting.

· Let Data Drive Better Questions

Stop relying on the “same as last year” approaches. Use actual data patterns to identify where risks have shifted, where business changes merit attention, and where your testing should focus.

· Eliminate Guesswork

No more requesting everything because you’re not sure what you’ll need. No more discovering halfway through testing that you need additional information. Complete data access means informed decisions from day one.

· Transform Client Relationships

When you walk into meetings with specific insights about their business performance, you’re no longer just a compliance provider – you’re a trusted advisor who understands their operations.

The bottom line: Validis doesn’t just make audits faster – it makes them fundamentally better.

TIP #1: Instant Standardized Work Papers

What do all these accounting reports have in common?

From the start of any audit, think about what you can automate. The first thing that comes to mind? Work papers.

Work papers should be in a consistent, standard format – doesn’t matter what system they came from.

You can’t automate your value.

But we’ll show you how to automate data collection, standardization, and work paper creation.

1.1 – 12+ standardized work papers

When you click the period, you want and hit generate, you get 12+ work papers.

All branded with your logo, your firm’s identity – not Validis.

→ See #ProTip: Custom Reporting Packs to customize your work papers.

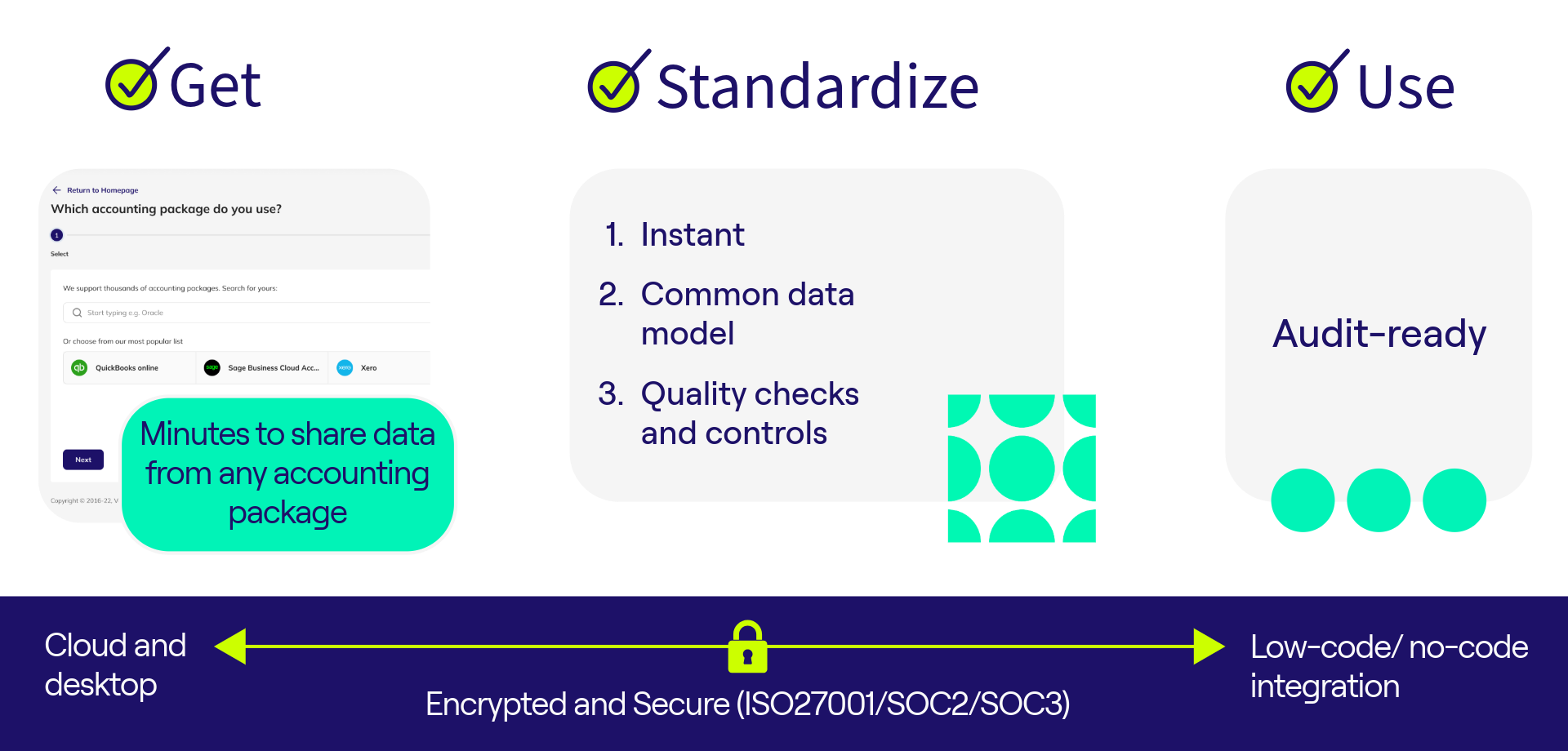

1.2 – Get ALL the data in minutes

Stop those awkward conversations where you ask for “the general ledger” only to get pulled into endless clarifications: “Well, was that manual journals that you wanted? Or was it automatic or was it everything?”

The Solution: Validis extracts 100% of the data automatically. No more guessing what you need or playing 20 questions with clients about data scope.

1.3 – Minutes to standardize

Stop spending hours making data look clean and consistent for partner review. One auditor even used to spend ages making specific colors within files to make them more appealing to the reviewing partner. Sound familiar?

The Solution: Once you click generate, everything is instantly standardized. No cleansing, no formatting, no color-coding needed. The data is audit-ready from the moment it’s extracted.

“You can’t really underestimate the savings of time that people get from proper standardized GL, AR or AP reports. Think about cleansing or manipulating those reports.”

1.4 – One format, all clients

Stop constantly learning new ERP layouts and struggling with inconsistent data presentation across different client systems.

The Solution: Consistent format across every engagement, every client. Repeatable automated routines for all audit procedures. The standardized reports include comprehensive AR and AP analysis – top debtors, aged receivables, detailed transaction history. You can immediately see which balances deserve sampling attention and why.

“You can see very quickly some of my sampling should definitely be done on probably the top five, maybe the top 10 because they make up just over 82% of the debtors… I can look at this instantly and see the big picture of this auditor company.”

#ProTip – Direct ERP access

Use your login credentials to extract data into Validis on behalf of your client without even involving them.

Most accounting packages create reports that still require manipulation. Even with direct access, you’re still spending time formatting and standardizing. Validis eliminates this entirely while delivering standardized reports without any additional work.

#ProTip: Custom reporting packs

Admin users can create custom reporting packs tailored to your firm’s specific needs. Select from a list of 20+ reports to create customized packs your team needs for different engagement types.

| Accounts Receivable Analysis: | Accounts Payable Analysis: | Financial Statements & Analysis: | Plus specialized reports for: |

|---|---|---|---|

|

|

|

|

Learn how to standardize your approach across all audits, and ensure consistency in work paper presentation: Custom Reporting Packs Guide

The Bottom Line: Consistency

Every single engagement, every single audit becomes a repeatable, automated routine. No more context switching between different client systems or spending hours on data manipulation.

TIP #2: Leverage Validis Analytics Dashboard

Start Smart: Now that you’ve got the data, let’s look at how you can use it to become a modern data-driven auditor.

This section focuses on that crucial first step when client data lands in your portal.

Before you dive deep into transaction details or get lost down the wrong analytical path, you need that initial high-level analysis that drives what questions to ask and what areas deserve your attention.

This is how you transform from reactive to strategic.

2.1 – Start with the quality score

Why start here? The Quality Score instantly flags potential bookkeeping issues and data gaps that need addressing upfront or gives you confidence in the data you’re auditing.

What you get: Smart insights into your client’s bookkeeping patterns – inconsistent accrual reporting, depreciation anomalies, suspicious account movements. These could be areas of concern that will need further analysis.

The real value comes from watching the video to see how experienced auditors interpret these signals and turn them into targeted questions.

2.2 – Navigate the full dashboard suite

Your dashboard arsenal includes:

- Overview – Sales, gross profit, net profit at a glance with year-over-year comparisons

- Profit & Loss – Revenue trends and margin analysis

- Working Capital & Liquidity – Cash conversion cycles and receivables aging patterns

- Credit Analysis – Risk indicators and financial health metrics

- Receivables – Aging analysis and collection performance

- Payables – Payment patterns and supplier relationship insights

The strategic advantage: Instead of asking generic planning questions like “How was your year?”, you’re asking specific, informed questions: “Why has your cash conversion cycle increased from prior year?” or “Your receivables over 90 days jumped 40% – what’s driving this change?”

Watch the video to see these dashboards in action and understand how they guide your audit approach from day one.

#ProTip: Screenshot dashboards for clients

Take screenshots of dashboard visuals and drop them directly into client planning meetings.

Clients are impressed seeing their business data presented professionally, and it demonstrates your immediate understanding of their operations.

#ProTip: Extract data multiple times

Extract client data at planning, year-end, or quarterly to track changes and adjustments. If you’re doing three/four extractions and letting Validis handle it in minutes rather than downloading reports month by month or quarter by quarter, the time savings become huge. This approach also lets you spot post-year-end adjustments and understand their impact on your audit conclusions.

The Bottom Line: Start Smart

As you can see, instead of “same as last year” approaches or random sampling, you’re letting the data lead you. This is how you become a modern data-driven auditor.

Next up: We’ll show you how to interrogate this data for deeper analysis and turn these insights into concrete audit procedures.

TIP #3: Interrogate 100% of Source Data

Now that you’ve identified areas of interest from your dashboard analysis, it’s time to investigate.

Here’s the critical question: Why would you use this capability? Most auditors get their work papers and carry out the audit the traditional way, missing the strategic advantage.

Your audit process changes When You Have Everything At Your Fingertips: 100% of their data since using that accounting package – without additional client requests. Unlike traditional audit sampling, you have every transaction, every journal entry, every double-entry posting that occurred during the period.

🎥 Watch the video below to see how infinitely more insightful Validis can be than static spreadsheets.

3.1 – Analyze multi-year trends

Why this matters: Go beyond current year comparisons to understand the complete business story.

What you get: Expand your data view to include 5+ years where data exists. Analyze trends, identify cyclical patterns in client operations, spot gradual changes that might indicate strategy shifts, and use historical context for better risk assessment.

3.2 – Access complete populations

Why this matters: Why would you ever need to ask for a trial balance again? It’s all here for you.

What you get:

- Complete general ledger – Every manual and automatic journal posted

- Multi-year access – Go back to 2016 if the data exists

- Full sub-ledger detail – AR and AP transaction-level data

- Real-time insights – See what’s been posted after year-end

Use complete population data to identify actual risks, target high-value transactions automatically, and focus on aged receivables over 90 days instead of hoping random samples catch issues.

3.3 – Filter for high-risk items

Why this matters: Move beyond statistical sampling to strategic targeting.

What you get: Filter by high amounts (transactions over £500,000), identify outliers worth investigating, track double entries to see both sides of every journal entry, and drill into aged analysis for receivables over 90 days, credit notes, and write-offs. Investigate unusual journal entry combinations that match your audit methodology criteria.

3.4 – Drill into sub-ledgers

Why this matters: Access detailed transaction-level data for comprehensive analysis.

What you get: Simultaneous access to accounts receivable and payables ledgers. Analyze aging patterns, identify unrecorded liabilities, examine credit note activity, and spot potential bad debts. All standardized regardless of the client’s accounting system.

#ProTip: Run statistical analysis

Use complete datasets using complete populations rather than samples for:

- Benford’s Law analysis (US firms love this)

- Altman Z-scores for financial distress analysis

- Journal Entry Testing to search high-risk account combinations

- ISA 520 final analytical reviews

#ProTip: Investigate in real-time

Immediate answers: Drill into specific accounts to examine transaction details, review double-entry relationships for unusual postings, analyze posting patterns for timing anomalies, and examine credit/debit relationships in suspicious accounts – all without additional client requests.

“I have a client that really loves to work in the middle of the night when his clients are asleep. He loves that if a question pops up, he can just go straight to the source data without having to put in a request to the client and wait on their response.”

#Pro Tip: Monitor post-year-end

Complete audit trail: When you extract at planning, year-end, and post-year-end, instantly see what adjustments were posted back to the audited period. Track changes and understand the complete story of year-end entries without follow-up requests.

Important Note: Data Availability

When using our gold standard connectors (Connect), you get 100% of the data as described above. If clients are using file upload (Upload), the data available is limited to what they choose to share – though our Smart Data Engine still standardizes everything they provide.

The Bottom Line: Strategic audits

This isn’t about doing more work – it’s about doing smarter work. Instead of hoping your random sample catches something important, you’re strategically targeting actual risks identified through complete data analysis. You’re moving from compliance-focused testing to insight-driven investigation.

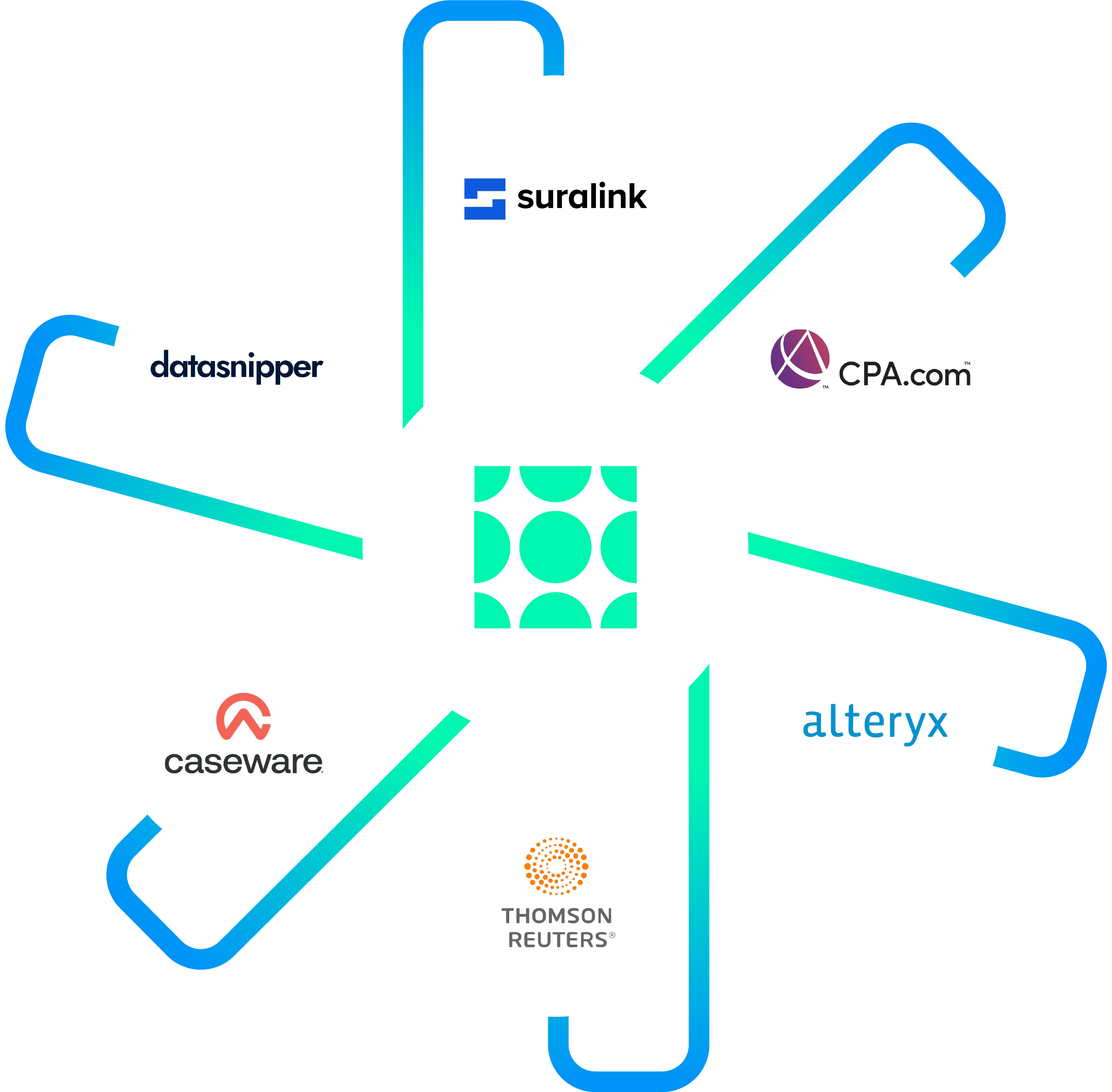

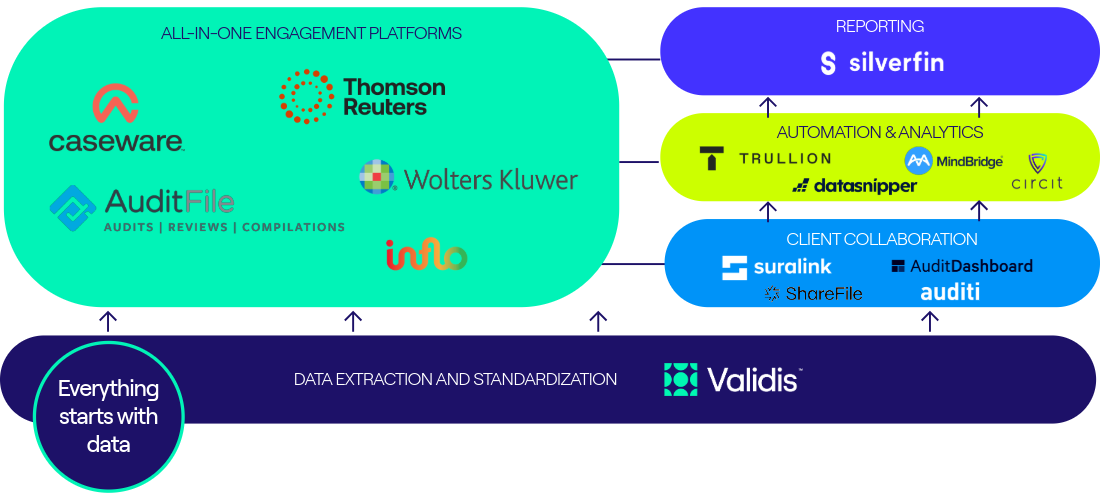

TIP #4: Integrate Your Audit Tools

Power Your Entire Audit Ecosystem: When You Have 100% of the Data, Everything Changes

When you have 100% of the data in the same standardized format every time, you have everything you need regardless of what technology you’re using.

When every tool in your tech stack works with the same high-quality, standardized data, you create a true single source of truth and complete consistency of approach. No more data silos, no more reformatting between systems, no more inconsistent approaches.

4.1 – Feed advanced analytics dashboards

Why this matters: Transform individual tools into a comprehensive risk assessment system.

What you get: Plug Validis data into GL analytics dashboards, purchase dashboards, or revenue dashboards for fuller risk assessment capabilities. Perform trend analysis by vendor, analyze each customer individually, and get deeper insights than any single tool could provide alone.

4.2 – Export digestible formats

Why this matters: No more manual formatting between systems.

What you get: Standardized file exports that are ready to upload directly into your audit technologies. The same clean format every time, regardless of client accounting system, means seamless integration with any platform in your tech stack.

4.3 – One-time setup

Why this matters: Eliminate duplicate setup and configuration across tools.

What you get: Configure your integrations once and benefit from consistent data flows across all engagements. No more recreating templates or reformatting data for different tools – everything works together automatically.

#ProTip: DataSnipper

Export Validis data directly into DataSnipper-ready format. Click Standard Reporting Packs and generate work papers for your chosen time period. Enable Validis templates in DataSnipper and the document matching knows exactly how your data is structured – saving setup time and getting straight to analysis. Watch the video above to see how.

For more details, visit the DataSnipper website.

#ProTip – Caseware

Eliminate manual work: Say goodbye to switching between platforms and manual document export/import by automating data flow between systems.

Increase efficiency: Experience seamless end-to-end processes with automated mapping of general ledger and trial balance data for consistency.

Centralize workflows: Intelligent automation minimizes errors while creating a dependable ecosystem of connected data with robust audit trails.

#Pro Tip: Thomson Reuters

The combined advantage: Validis solves your data foundation while Thomson Reuters provides AI-powered audit intelligence. Together, they transform traditional compliance exercises into strategic, insight-driven audits.

What you get: Risk assessment that groups transactions into High, Medium, and Low risk categories, strategic sampling focused on high-risk items, and automated documentation generation – all powered by Validis’s standardized data quality.

Impact: While others struggle with “garbage in, garbage out,” you’re delivering AI-powered insights built on gold standard data.

The Bottom Line: Single source of truth

We get financial data. That’s our focus. By doing one thing exceptionally well – delivering standardized, audit-ready data – we power your entire audit ecosystem.

Your audit technology is only as good as the data feeding it. Make sure it’s the best.

TIP #5: Turn Clients into Super Fans

This tip gives you everything you need to make Validis a no-brainer for you and your clients.

This is modern, streamlined, and exactly what today’s digital-native clients expect from their professional service providers.

5.1 – Modern client journey

Why clients love this: Watch this quick second video to see how easy it is to share data.

What they experience:

- Email invitation (white-labeled to your brand)

- Click their accounting package (e.g., QuickBooks Online)

- Standard authentication through their ERP

- Data shared automatically

The real win: Clients save 7.3 hours in data gathering time compared to traditional requests.

As one auditor noted:

“Half of what I’m going to ask you for, you press this one link, put in your passwords, do a quick data share. You don’t need to worry about it on the day.”

5.2 – Enterprise-grade security

Why clients love this: Peace of mind with bank-level protection.

What they get:

- SOC 2 Type 2 and ISO27001 certified – Independently audited annually

- 256-bit AES encryption – Industry’s strongest available protection

- Azure platform hosting – Microsoft’s enterprise infrastructure

- Zero data training use – Their information stays private

- Complete access control – They decide who sees what

The confidence factor: When clients know their data is protected by the same standards used by major financial institutions, security concerns disappear.

5.3 – Brand-consistent journey

Why clients love this: Seamless brand experience throughout.

What they see:

- Your firm’s logo and branding on every screen

- Email invitations that look like they came from you

- Portal interface that matches your professional identity

- No “third-party tool” confusion

The strategic advantage: Clients experience this as your innovative solution, reinforcing your firm as tech-forward and client-focused.

#ProTip: Client comms arsenal

We’ve created everything you need to get clients excited about the experience:

- Engagement letter copy – Pre-written sections for your letters

- Heads-up emails – Multiple tones so you can match your style

- One-pager overview – Perfect for client meetings or when clients want more information

- Snappy explainer video – Show, don’t just tell. You can share this link, or download a copy to embed on your website.

- Security summary – Address concerns before they arise

- SOC 3 Report

Beyond Audit: Additional Use Cases

Review Engagements

- Use dashboard analytics for preliminary analytical procedures

- Apply ratio analysis for ISA 520 requirements

- Leverage multi-year trend data for variance explanations

Tax Services

- Historical data access for prior year comparisons

- Complete transaction detail for specific tax queries

- Standardized reporting for tax compliance procedures

Advisory Services

- Benchmarking using industry-standard data formats

- Cash flow analysis using complete transaction history

- Business performance analytics using dashboard insights

Quick Recap

- Automate standardization – Your value isn’t in Excel formatting

- Arrive prepared – Data-driven questions beat generic checklists

- Access everything – Stop the back-and-forth client requests

- Integrate smartly – Build a connected audit ecosystem

- Enable success – Make adoption effortless for clients

You can’t automate your value. But you can automate everything else: data collection, standardization, work paper generation, client communication.

We get financial data. You deliver the insights. That’s how modern audits work.

The firms transforming aren’t working harder – they’re working smarter with better data, better tools, and better client relationships.

What’s your next round of engagements? Start smart and get the data now. There’s no reason to wait.

Ready to get started? Your account manager is standing to help implement these practices. Contact the team or use the support button in your Validis portal.