Does the integration story actually stack up to reality?

We 🤫 and let Andrew O’Donnell, Manager at Citrin Cooperman at Citrin Cooperman, and Stephen Panfile, Senior Manager at Withum, answer for us.

Two firms. Two different ways of using Validis + Caseware.

The same game-changing result: when data flows seamlessly, audits get faster, cleaner, and a whole lot less painful — for both teams and clients.

They didn’t hold back — sharing what’s working, what they’d do differently, and why firms that hesitate will get left behind.

What’s insde:

- See exactly how Stephen’s team saves 20 minutes per GL search with integrated dashboards.

- Discover why Andrew “usually doesn’t give teams a choice” about using Validis — and why that gets results.

- Follow the 3-step adoption playbook that worked for both firms (including the “rip the band-aid off” approach).

Read on for the top takeaways — or jump to minute 15 of the video to skip the intros and get straight to the good stuff.

1. The Expanded Role of Data in the Audit

Integrated data has completely changed the way Stephen’s teams approach planning and risk assessment.

Gone are the days of pulling incomplete information late in the process and asking generic questions. Now, the data is ready upfront — complete, standardized, and easy to interrogate.

“When you’re able to look at all the data from your clients through a different lens… you drive a higher-quality audit overall.”

That “different lens” means spotting anomalies immediately, tailoring questions to real issues, and ditching the one-size-fits-all approach. Staff spend less time on manual cleanup and more time on analysis, which clients notice.

Andrew, sees it as Citrin Cooperman’s way out of the SALY (“same as last year”) trap. While SALY still works when nothing changes, real-time access to client data means current-year events — the large Q2 transaction, the new service line, the ratio that’s suddenly off — can shape the audit from the start.

“Having more access to data allows us to not just rely on last year — you can let the data drive your audit instead of just saying, ‘We did this last year, so we’ll do it again.’”

This isn’t just about efficiency — it’s about positioning your firm ahead of competitors who are still running on stale, manual processes. The faster you can see and act on the right data, the faster you deliver value your clients didn’t expect.

What this means for you:

- Don’t wait for fieldwork to find anomalies — spot them during planning and focus only where the real risks are.

- Use live ratios and trends as teaching tools for junior staff — they’ll understand your clients’ businesses faster.

- Show clients insights they didn’t know you had — that’s how you shift from compliance necessity to strategic partner.

2. The Importance of an Integrated Solution

For Stephen, the Caseware + Validis integration has been a game-changer — and not just for efficiency’s sake. It’s about making better decisions earlier.

“What might’ve taken 20 minutes to find in the GL, we can find in two seconds.”

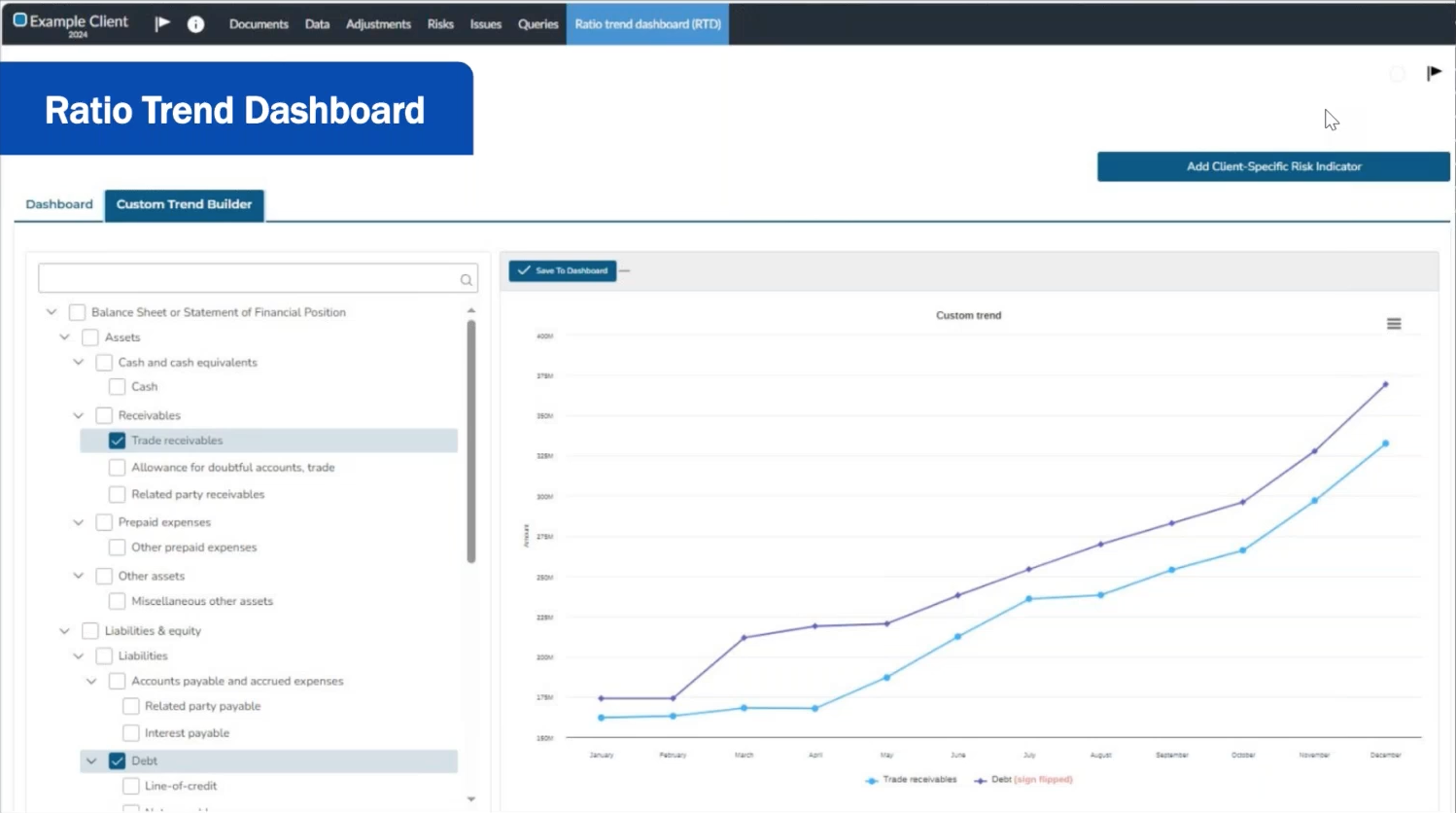

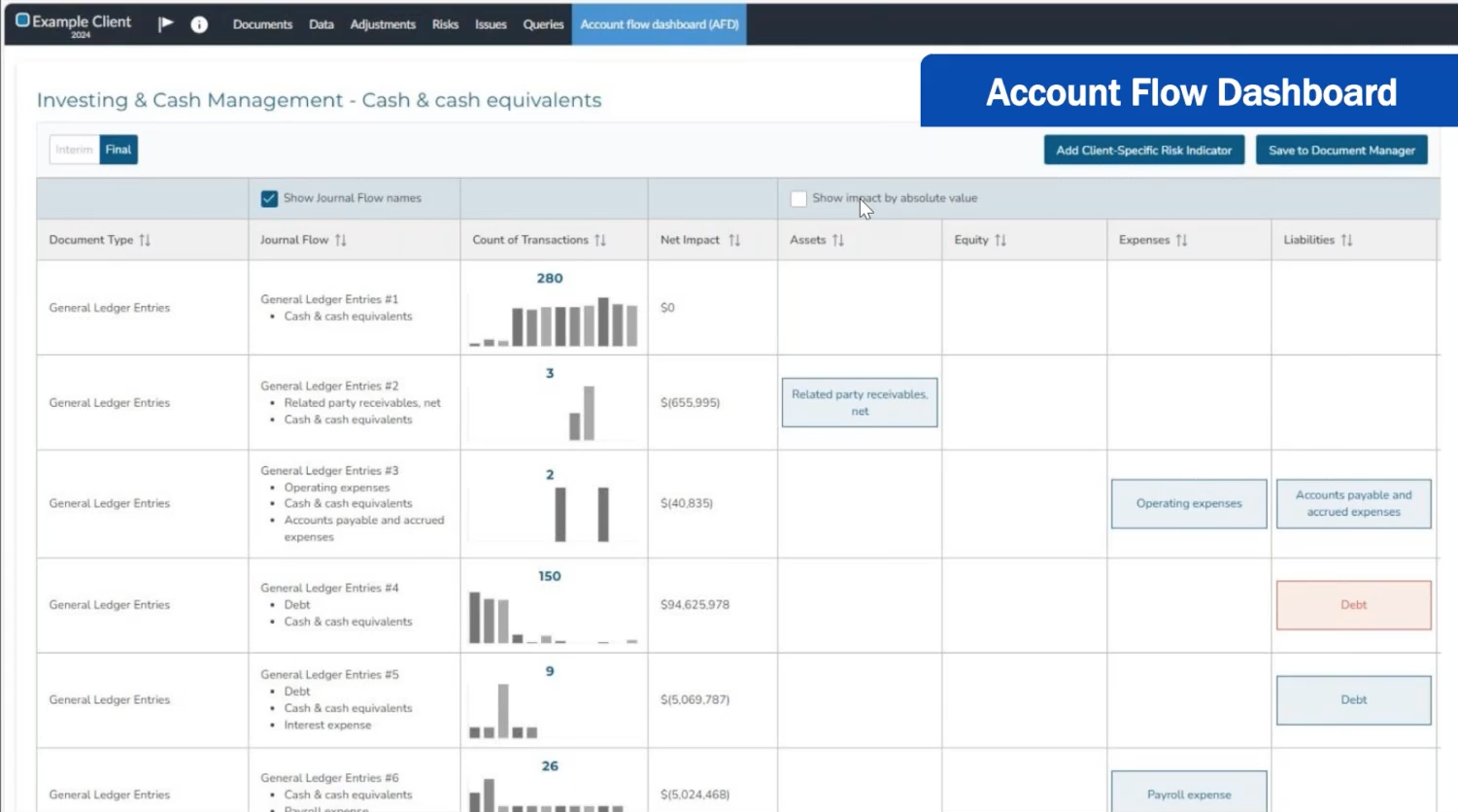

With a single click, data flows from Validis into Caseware’s analytics tools, instantly populating dashboards like the Ratio Trend and Account Flow. That means no manual formatting, no duplicate mapping, and no chasing clients for missing figures.

How Stephen’s team uses it in practice:

- Ratio Trend Dashboard: Compare accounts year-over-year, spot correlations, and flag anomalies worth investigating before fieldwork begins.

- Account Flow Dashboard: Hover to see exactly where transactions occurred, drill down to related-party activity, and target questions to specific events.

Stephen’s advice: integrate these tools into planning meetings. “Fail to plan, plan to fail” isn’t just a cliché — with dashboards live in front of the team, planning becomes a genuine risk-targeting session, not an admin exercise.

Andrew takes a similar view — but with a hard line on adoption.

“If we’re working on this job, we’re going to use Validis… I usually don’t give them a choice.”

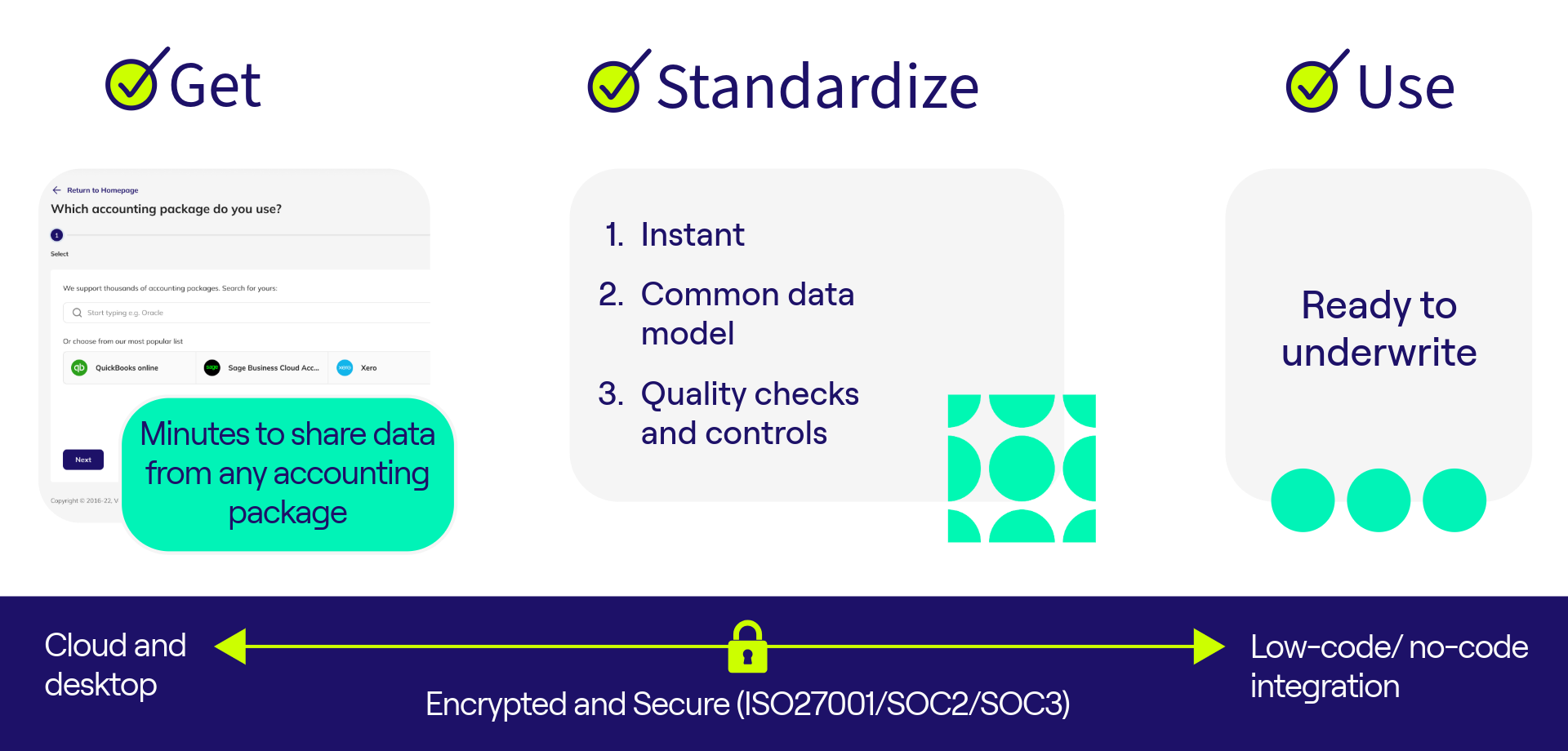

For him, the value is in clean, consistent data from day one. Clients connect to Validis in minutes, and because it uses their own account mappings, every report (from AR aging to the trial balance) agrees. No time lost reconciling, no delays from mismatched numbers.

How Andrew’s team makes it work:

- Quick client onboarding: The first connection takes 5–10 minutes; subsequent updates take seconds.

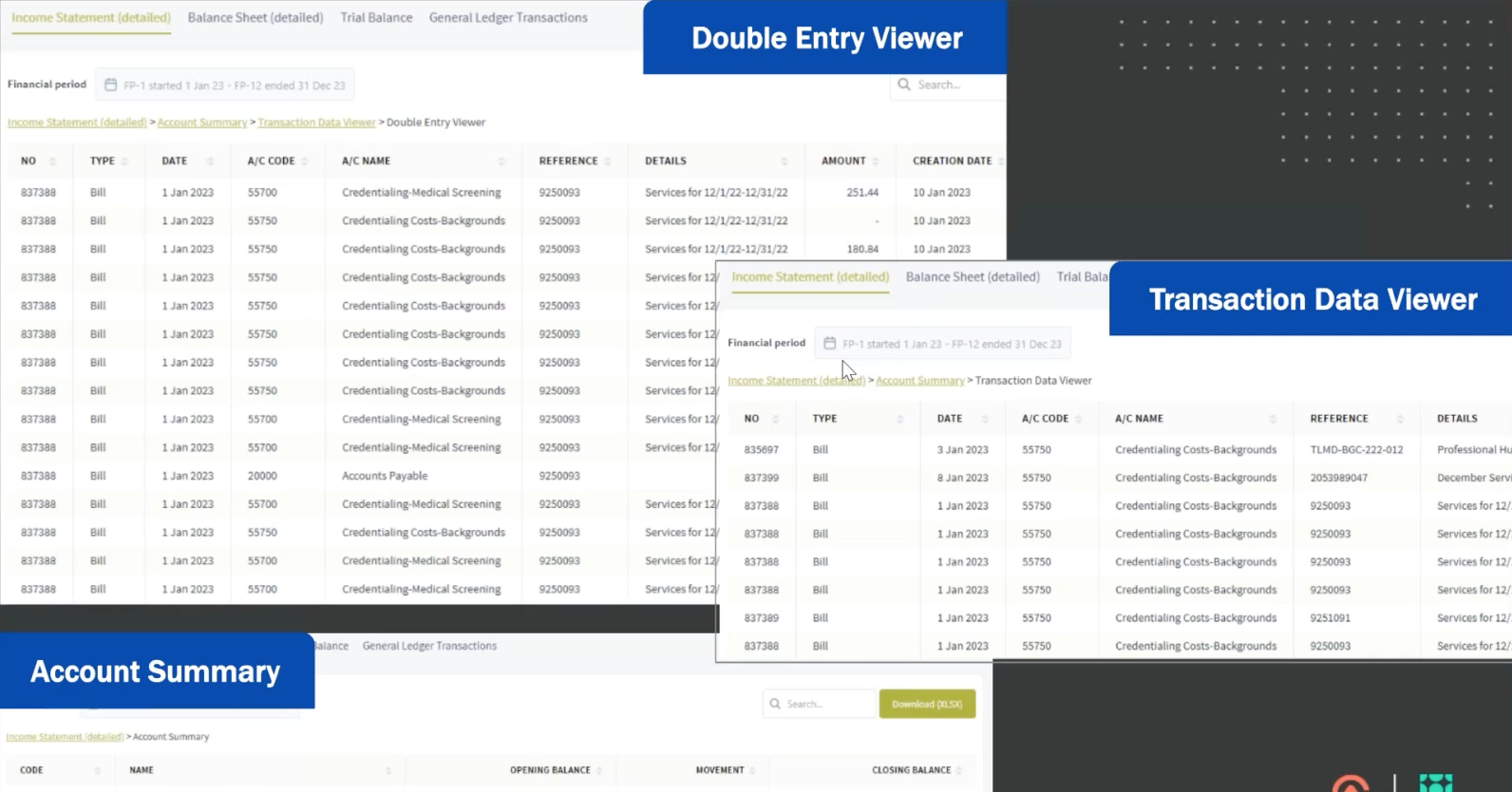

- Drill-down for clarity: Click from the income statement into a specific account, down to a specific day, and see the complete double-entry view.

- Focus on anomalies, not admin: Use the data to ask better questions — the kind that save both client and auditor time.

What this means for you:

- Stop wasting time reconciling messy client data — standardize at source.

- Bring dashboards into your planning process so risk areas are identified and scoped before fieldwork.

- Be firm about adoption — the competitive edge comes from using the integration on every job, not just some.

3. Implementation & Adoption: The 3-Step Playbook

Even the best tech falls flat if no one actually uses it. For both Stephen and Andrew, success with Caseware + Validis came down to three things: champions, structure, and patience.

Step 1 — Appoint your champions

Stephen’s rule: you need people who are all in on the “data revolution.” These aren’t just trained users — they’re advocates who can show others the benefits in real client scenarios.

“You have to have people that are not only using it, but have completely bought in… those are the people that can get it done.”

At Withum, champions lead by example during planning meetings and pull others into richer, data-driven client conversations. Once they’ve proven it works, adoption spreads naturally.

Step 2 — Build the support network

Andrew’s team made it easy for staff to get help in real time:

- Firm-wide trainings (but backed up with on-the-job support).

- A Teams channel for quick peer-to-peer questions.

- Virtual “office hours” for live Q&A.

- Best-practice emails to keep skills sharp.

This ensures no one is stuck wondering how to use the tool when they need it most.

Step 3 — Rip the band-aid off

Both firms agree — don’t drag out implementation. Roll out Caseware and Validis together to avoid two separate change cycles. The first year may be bumpy, but the long-term payoff is worth it.

Andrew’s advice:

“Be patient… you’re not going to be a master of the new technology right away. But if you hesitate, someone else won’t, and they’ll be more efficient and more effective than you.”

What this means for you:

- Pick your champions early and let them lead the charge.

- Create an always-on support system — don’t rely on one-off training.

- Go all in — the fastest route to ROI is full adoption across engagements.

4. Looking Ahead: From Compliance to Competitive Advantage

For Andrew, the Caseware + Validis integration isn’t just about getting today’s audit done faster — it’s about using audit data to deliver value clients didn’t expect.

If auditors can spot cost anomalies, benchmark against industry trends, or flag operational shifts, they’re not just ticking boxes — they’re helping clients run better businesses.

“If we can use all the data, look at different trends and ratios, and say, ‘Your costs in this sector are a little higher than industry norms,’ that’s valuable.”

And looking ahead to AI? Andrew’s clear: it only works with clean, standardized data.

“As firms explore AI tools, you need standardization to train them effectively. That’s where Validis fits in.”

Stephen takes the long view on efficiency — and profitability. Small time savings, multiplied across hundreds or thousands of engagements, are game changers.

“If we can save five minutes on a task for every single audit, that’s hundreds of thousands of dollars in WIP saved.”

Both see the same opportunity: firms that move fast on adoption will deliver more value to clients, run more profitable audits, and be better positioned for the AI-driven future. Firms that wait will be playing catch-up.

One thing to take away?

Andrew:

“You’re not going to be a master of the new technology right away… but if you hesitate, someone else won’t.”

Stephen:

“Right now is the slowest it’s going to be. Tomorrow it’s going to be even faster… rip the band-aid off and get going on your change management.”

What this means for you:

If you’re still debating whether to connect your data and standardize it, you’re already behind. The firms that integrate now will own the efficiency gains, the client trust, and the AI advantage.

Watch the full conversation

We’ve pulled out the highlights here — but the real value is hearing Stephen and Andrew walk through their processes, share screen-level details, and talk candidly about what worked (and what didn’t).

If you want to see exactly how they:

- Spot anomalies in seconds instead of minutes.

- Get clean, mapped client data on the first try.

- Roll out new tools firmwide without the usual pushback.

…then watch the full webinar: Interoperability in Action: Powering Data-Driven Audits with Integrated Technology Tools.

Andrew doesn’t give his teams a choice about using the Validis × Caseware integration. Stephen says “rip the band-aid off” and implement everything at once. Both firms are spotting risks in 2 seconds that used to take 20 minutes.

While you’re debating whether to modernize, your competitors are already there.

Chat with our team and see what standardized, audit-ready data looks like when it’s embedded directly into your Caseware workflow — plus a few extra things only Validis can do.

Can’t wait to see how it works? We’ve dropped in our demo video below so you can watch the integration in action. You’re welcome.