Mid-market business lending stands at a crucial inflection point. While many North American business leaders express strong confidence in their companies’ financial outlook [13], traditional lending processes continue to create unnecessary friction between capital providers and the growing companies they serve. To thrive in today’s digital-first environment, commercial lenders must embrace on-demand accounting data that delivers the speed and convenience that modern businesses demand.

What’s Inside

- Discover how on-demand accounting data can give lenders the speed advantage they need to win

- Learn how leading institutions like Citi are using on-demand accounting data to deliver fast approvals and seamless digital experiences

- Explore how standardized financial data reduces processing costs by 50% while powering AI initiatives for future competitive advantage

The Mid-Market Opportunity: Growing Appetite Meets Rising Expectations

North American mid-market businesses are demonstrating remarkable growth ambition. Recent survey data from KeyBank shows strong year-over-year growth despite the macroeconomic headwinds.

More importantly, 95% of businesses concerned with access to capital or credit are actively exploring multiple financing sources [13]. This represents a massive opportunity for lenders who can differentiate themselves through superior client experience and speed to decision.

The Growth Investment Reality

Today’s mid-market businesses are investing heavily in expansion:

- 54% are implementing AI to drive operational efficiency

- 50% are adding employees to support growth initiatives

- 49% are expanding use of technology and automation [13]

These companies are integrating digital throughout their operations and actively seeking capital to fuel their growth ambitions, so they expect their financial partners to operate with similar technological sophistication.

The Speed Advantage

With multiple financing options available — mega-banks, national players, regional and community lenders, private equity, private credit, and specialty non-bank lenders —businesses make strategic choices based on service quality and speed.

The question isn’t whether these businesses need capital —> 75% are actively seeking it [13].

The question is: which lenders will win their business by delivering the fast, frictionless experience they demand?

Ready to transform your commercial lending operations? Contact Validis today to learn how on-demand accounting data can revolutionize your client experience.

The Tech is Already Here: What’s Holding Lenders Back?

The research tells a compelling story about why traditional lending processes fall short:

- 81% of businesses find traditional lending application processes “excessively complex and time-consuming” [1]

- 67% of businesses abandon loan applications due to lengthy decision times with traditional lenders [2]

- 74% of businesses report spending 15+ hours on paperwork when applying for working capital financing [3]

Let’s be honest – businesses that can implement AI and automate their operations in months aren’t going to tolerate weeks-long lending processes built around paper documentation.

Citi’s Digital Leadership: Proof of Concept in Action

Citi Commercial Bank has already demonstrated what’s possible when commercial lenders embrace digital transformation. Their recent platform enhancements showcase the power of on-demand accounting data in action. Learn more about Citi’s digital lending transformation.

“These enhancements support our commercial banking clients by offering quicker, more efficient and tech-led financing options to meet their capital needs. Many CCB clients are fast-growing companies, and this improved lending experience is consistent with how they operate their own businesses.” – Tasnim Ghiawadwala, Head of Citi Commercial Bank

Citi’s Digital Credit Application Results:

- 15 business days average for approval decisions

- 30 business days average for fund disbursement

But perhaps most tellingly, Citi’s automated credit management process includes “directly and securely connecting their ERP or accounting platform for a seamless push of data, powered by Validis.” Read the full press release.

“Digitally enhancing our client experience ensures we offer rapid support for common needs. We consistently explore ways to leverage innovative technology, including artificial intelligence powered tools to increase automation.” – Colm Donnelly, Head of Digital Lending Transformation and Partnerships for Citi Commercial Bank

See how Validis can streamline your commercial lending operations. Book a demo today and discover the power of on-demand accounting data.

On-Demand Accounting: The Foundation for Modern Commercial Lending

At the heart of this evolution is on-demand accounting data – the secure, permission-based access to real-time financial data directly from a client’s accounting system. This approach eliminates the administrative burden that has traditionally plagued commercial lending:

From Document Collection to Direct Data Access

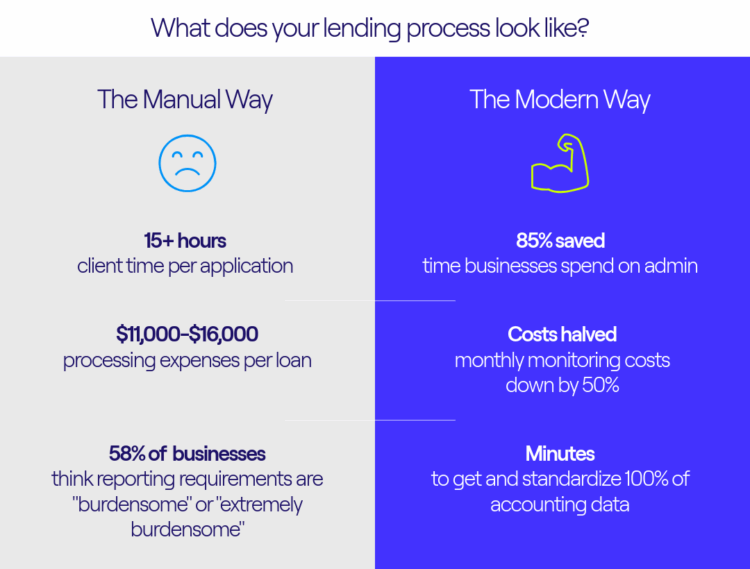

Traditional commercial lending relies on clients manually preparing and submitting financial documentation. This process typically consumes 15+ hours of client time per application [3] and costs lenders between $11,000-$16,000 per commercial loan application in processing expenses [4].

From Monthly Monitoring Burden to Automated Insights

Mid-market lenders allocate 31% of operational costs to data management processes that could be automated [5]. The ongoing monitoring process creates significant friction, with 58% of businesses considering reporting requirements “burdensome” or “extremely burdensome” [6].

With standardized, real-time accounting data, both clients and lenders win. Businesses save up to 85% on administration, while lenders benefit from a 50% saving on monthly monitoring costs.

Client-Centricity: Meeting Digital Natives Where They Are

The mid-market is experiencing a generational shift as digital natives increasingly take CEO and CFO roles. These new leaders—who built their careers in the smartphone era—expect the same digital experience from their lender that they get from their enterprise software providers.

Research highlights key barriers including “overly bureaucratic processes” and “speed of onboarding” that directly impact client adoption. On-demand accounting data transforms the client journey from a paper-heavy administrative burden to a seamless digital experience.

The New Client Promise:

- “Just connect your accounting system and we’ll handle the rest”

- “No more monthly data prep—we’ll get what we need automatically”

- “Decisions in days, not weeks”

This client-centric approach doesn’t just reduce friction; it fundamentally changes how businesses perceive commercial lending. Instead of a necessary evil with burdensome requirements, it becomes a true enabler of growth and competitive advantage.

Client Experience Metrics:

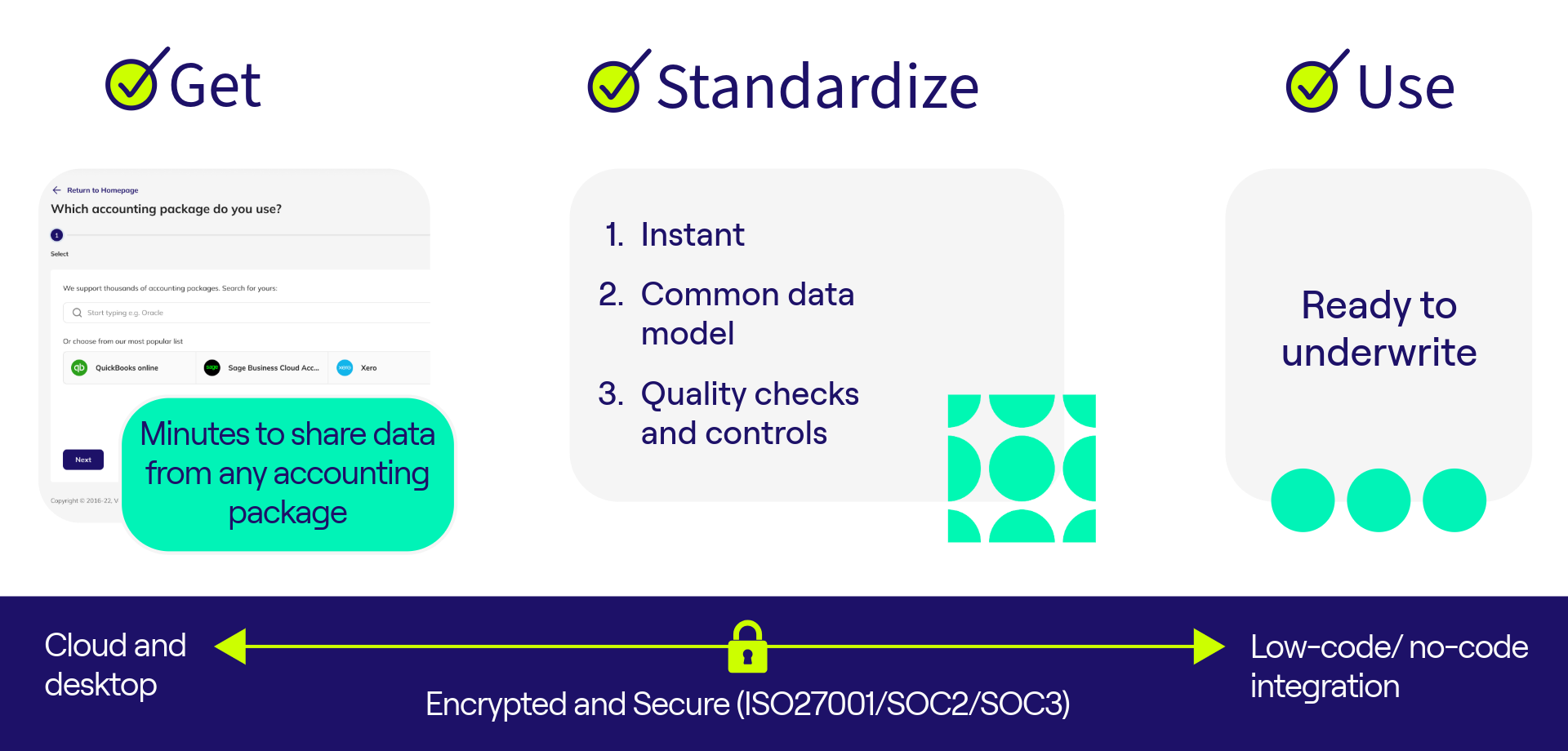

96% of businesses are happy to share accounting data direct from their accounting system [12]. And who can blame them when it results 5 days faster time-to-cash [10]. Here’s how it works:

Want to see how on-demand accounting data transforms the client experience? Schedule a consultation with our team today.

Beyond Efficiency: Powering AI and Future Innovation

Perhaps the most compelling advantage of standardized financial data is its impact on risk management and future AI capabilities. Currently, 63% of commercial lenders acknowledge making credit decisions based on financial data that is 4-6 months old [7].

On-demand accounting data fundamentally changes this dynamic:

- Real-Time Information: Base decisions on today’s financial reality, not historical snapshots

- Early Warning Signals: Identify deteriorating performance before it impacts facility performance

- Reduced Defaults: Real-time data access could reduce default rates by 36% [8]

- Identify new opportunities: understand your clients’ businesses in more depth and propose new financing, hedging and transactional solutions

But there’s more to the story. Quality data is the foundation for all your AI and automation ambitions. Without clean, standardized financial data, even the most sophisticated AI tools will falter—it’s the classic “garbage in, garbage out” problem.

“The continued roll out of these new digital lending capabilities to new geographies remains a key priority. We consistently explore ways to leverage innovative technology including artificial intelligence powered tools to increase automation.” – Colm Donnelly, Citi Commercial Bank

Risk Management Improvements:

- 36% potential reduction in default rates [8]

- Real-time vs. 4-6 month old data [7]

- Foundation for AI-powered credit decisions

Contact our team to discuss how lenders are already using on-demand accounting data to power their AI initiatives.

Building Internal Consensus for Digital Transformation

Implementing on-demand accounting data requires alignment across multiple stakeholders. Here’s how to address key concerns from different departments:

- For Risk Teams:

Emphasize how standardized, real-time data improves risk assessment accuracy and reduces defaults through earlier intervention. Real-time data access could reduce default rates by 36% [8] compared to traditional methods.

- For Operations:

Highlight the 50% reduction in data processing costs [9] and 75% capacity improvement for relationship managers, enabling them to focus on relationship building rather than data collection.

- For Client Experience:

Focus on the 85% reduction in administrative burden for clients and dramatic improvement in time-to-cash. This directly supports client retention and acquisition in competitive markets.

- For Tech and Innovation Teams:

Discuss how standardized financial data creates a foundation for future AI and automation initiatives, positioning the institution as a digital leader.

- For Executive Leadership:

Present the complete business case, including documented 6x ROI and 52% operational cost savings [10]. Emphasize how on-demand accounting data creates capacity for growth while improving competitive positioning.

Need help building your business case? Contact our team to help quantify the benefits for your organization.

Seizing the Opportunity: The Time for Action is Now

The North American mid-market presents a unprecedented opportunity for commercial lenders. Businesses are growing, they prefer commercial lending over alternatives, and they’re ready to embrace digital solutions that match their operational sophistication.

The question isn’t whether to implement on-demand accounting data – it’s how quickly you can get started.

Leading institutions like Citi, Barclays, Santander, ABN AMRO are already demonstrating the significant benefits of this approach. They’re not just reducing costs—they’re fundamentally transforming their value proposition and competitive positioning.

The question is: how quickly will you adapt?

Next Steps

Ready to explore how on-demand accounting data can transform your commercial lending operations? Contact Validis today to discuss how we can help you access real-time accounting data quickly and securely.

Our proven implementation approach helps commercial lenders achieve >90% client adoption while delivering measurable improvements in efficiency, risk management, and client satisfaction.

We get financial data. Let us show you how.

Sources

[1] Ernst & Young’s “Global SME Finance Outlook” (2024). Available at: https://www.ey.com/en_gl/banking-capital-markets/global-sme-finance-outlook-2024

[2] The Oxford Business Group, “SME Financing Trends 2024.” Available at: https://oxfordbusinessgroup.com/reports/sme-financing-trends-2024

[3] Forrester Research, “SME Financing Experience Report” (2023). Available at: https://www.forrester.com/report/sme-financing-experience-report/RES176542

[4] KPMG’s “Lending Efficiency Report” (2024). Available at: https://home.kpmg/xx/en/home/insights/2024/01/lending-efficiency-report.html

[5] Financial Conduct Authority (FCA), “Invoice Finance Market Study.” Available at: https://www.fca.org.uk/publications/market-studies/invoice-finance-market-study

[6] Association of Finance Professionals, “Working Capital Optimization Report.” Available at: https://www.afponline.org/publications-data-tools/reports/survey-research-economic-data/working-capital-optimization

[7] S&P Global Market Intelligence, “Commercial Lending Risk Report 2024.” Available at: https://www.spglobal.com/marketintelligence/en/news-insights/research/commercial-lending-risk-report-2024

[8] International Finance Corporation, “Digital Financial Services for SMEs.” Available at: https://www.ifc.org/en/publications/digital-financial-services-smes

[9] PwC’s “Digital Lending Benchmark” (2023). Available at: https://www.pwc.com/gx/en/industries/financial-services/publications/digital-lending-benchmark-2023.html

[10] Validis client case study data from leading financial institutions, including Barclays implementation results.

[11] World Bank SME Finance Forum (2024), “MSME Finance Gap.” Available at: https://www.smefinanceforum.org/data-sites/msme-finance-gap

[12] Validis customer and client research data

[13] KeyBank Middle Market Business Sentiment Report – 1H 2025. Available at: https://www.key.com/businesses-institutions/business-expertise/articles/mm-report-1h-2025.html